Articles

Investing in Style: The Rolex Daytona’s History and Investment Potential

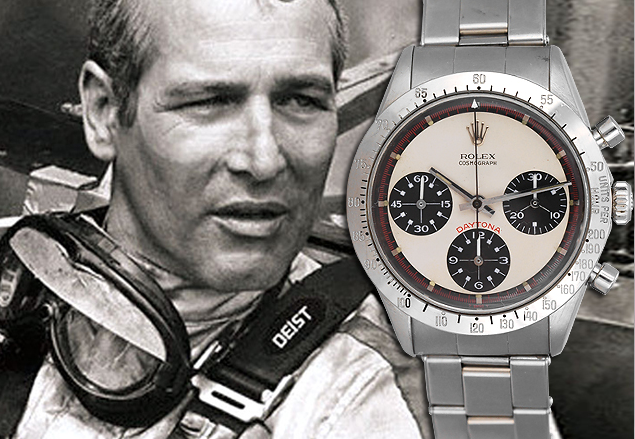

The Rolex Daytona is a legendary timepiece that has been sought after by collectors and enthusiasts for decades. The watch was first introduced in the 1960s and was designed specifically for professional race car drivers. The Daytona quickly gained a reputation for its precision and reliability, making it a favourite among motorsports enthusiasts. But the Daytona is not only known for its performance on the racetrack, it’s also known for its performance as an investment. In this article, we at Watches of Distinction will delve into the history of the Rolex Daytona and explore why this iconic watch has proven to be such a strong financial investment over the years.

The Rolex Daytona was first introduced in 1963 and was named after the famous Daytona Beach race track in Florida, USA. The watch was designed to meet the needs of professional race car drivers, and it featured a chronograph function, which allowed the wearer to measure elapsed time. The watch was powered by the Rolex Caliber 722, a manual winding movement that was later replaced by the automatic Caliber 4030 and then the 4130. The watch also featured a tachymeter bezel, which was used to calculate the speed of a vehicle over a known distance.

The Rolex Daytona quickly gained a reputation for its precision and reliability, and it became a favourite among professional race car drivers and motorsports enthusiasts. However, the watch was not initially a commercial success, and Rolex produced relatively few Daytonas in the 1960s and 1970s. It wasn’t until the 1980s that the watch began to gain popularity among collectors, and its value began to appreciate.

One of the reasons for the Daytona’s increased popularity in the 1980s was its association with Paul Newman, a famous actor and racing enthusiast. Newman was often photographed wearing a Daytona, and his association with the watch helped to increase its visibility and desirability among collectors.

Another reason for the Daytona’s increased popularity in the 1980s was its scarcity. Because Rolex produced relatively few Daytonas in the 1960s and 1970s, the watch became highly sought after by collectors. This scarcity, combined with the watch’s historical significance and association with Paul Newman, helped to drive its value upward.

As the popularity of the Rolex Daytona continued to grow in the 1990s and 2000s, the watch became a favourite among investors. The watch’s historical significance, association with Paul Newman, and scarcity made it a highly desirable and valuable item. Additionally, the watch’s iconic design and reputation for precision and reliability made it a favourite among collectors.

The Rolex Daytona has continued to appreciate in value over the past decade, and it remains one of the most sought-after watches in the world. Today, the watch is considered a blue chip investment and is widely regarded as one of the best financial investments among luxury watches.

Read more about why investing in a vintage Rolex Daytona is a smart financial decision.

Find our selection of Rolex watches here